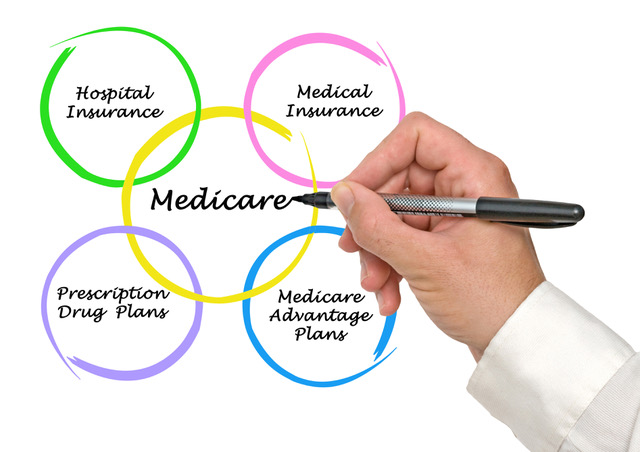

What are Medicare Advantage Plans?

A Medicare Advantage Plan (like an HMO or PPO) is another way to get your Medicare coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private insurance companies. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get your Medicare Part A & Part B coverage from the Medicare Advantage Plan, not Original Medicare.

Medicare Advantage Plans cover all Medicare Part A and Part B services.

In all types of Medicare Advantage Plans, you’re always covered for urgent and emergency care. All of them also have an annual maximum out-of-pocket limit for medical costs. If you reach that amount, the plan will pay 100% for the remainder of the year for your Medicare-approved services. Medicare Advantage Plans must cover all of the services that Original Medicare covers. However, Original Medicare will still cover hospice care, if needed.

Most Medicare Advantage Plans offer extra coverage, like vision, hearing, dental, and other health and wellness programs. Most also include Medicare prescription drug coverage (Part D).

In addition to your Part B premium, you might have to pay a monthly premium for the Medicare Advantage Plan.

Medicare Advantage Plans must follow Medicare’s rules.

Medicare pays a fixed amount for your coverage each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to doctors, facilities, or suppliers that belong to the plan’s network for non-emergency or non-urgent care).

The plans are annual contracts and can change each year.

Medicare Advantage Eligibility Requirements

In order to be eligible to enroll in a Medicare Advantage plan, you must have Medicare Part A & Medicare Part B, live in the plan’s service area, and not have End Stage Renal Disease (kidney failure).

When Can You Enroll?

There are timeframes for enrollment in to Medicare Advantage and Prescription Drug Plans.

Initial Enrollment Period

Begins three months before and ends three months after the month of the individual’s Medicare eligibility date (typically 65th birthday). The beneficiary can choose any type of plan during the Initial Election Period (IEP).

Open Enrollment Period (or Annual Election Period)

October 15th to December 7th

Every year, Medicare has an open enrollment period when you can make a change using your annual election period. Since all plan contracts are annual, there may be changes. Between October 15th and December 7th you can make a new plan choice that will be effective January 1 of the following year.

Medicare Advantage Disenrollment Period (MADP)

January 1st to February 14th

Medicare created this timeframe to help protect people that may have enrolled in a plan without knowing the details, so they give them the option to return to Original Medicare and enroll in a Stand Alone Part D, if they choose.

Special Election Period (SEP)

In most cases, you must stay enrolled for the calendar year starting the date your coverage begins. However, in certain situations, you may be able to join, switch, or drop a Medicare Advantage Plan during a Special Enrollment Period.

Some examples are:

- You move out of your plan’s service area.

- You have Medicaid or qualify for Extra Help program.

- You live in an assisted living facility (like a nursing home).

- Enrolling into a Plan with 5 Stars.

Different Types of Medicare Advantage Plans

There are several different types of Medicare Advantage plans. (Not all plans are available in all areas.)

Health Maintenance Organization (HMO)

- In most HMO plans, you can only go to doctors and hospitals in the plan’s network, except in urgent or emergency situations. Most plans require a referral to see a specialist.

Health Maintenance Organization – Point of Service (HMO-POS)

- HMO-POS has a network of doctors and hospitals, however, they do have limited ability to go outside of the network, generally for higher costs, except in urgent or emergency situations.

Preferred Provider Organization (PPO)

- PPO plans allow you to go outside of their network of doctors and hospitals, but it will generally cost you more in copays and coinsurance, except in urgent or emergency situations. Doctors may choose to not accept a plan out-of-network, so it is important to find out before enrolling in a plan or scheduling an appointment.

Private Fee For Service (PFFS)

- PFFS plans generally allow you to go to any doctor that is willing to accept the terms of the plan, but the doctor may change their mind about accepting the plan at any time, even if you’ve seen them before, except in urgent or emergency situations.

Special Needs Plan (SNP)

- SNP plans generally require you receive care from a network of doctors and hospitals, except in urgent or emergency situations. SNP plans also carefully manage and coordinate your care to make sure your special needs are being treated properly. Not all plans are available in all areas. SNP plans are for specific groups of people, such as those with Medicare and Medicaid, those that live in a nursing home, or those that are diagnosed with certain chronic, disabling conditions such as diabetes or heart disease.

Benefits of working with a HC Insurance agent:

- We are able to listen to your needs to help you find the plan that works for you.

- We are available to answer questions throughout the year.

- We are available to conduct annual reviews – in addition to the possible plan changes, your health needs may change, so it is always a good idea to review your plan options.

Contact us today.